Big data analytics in valuing and selecting small- and medium-capital stocks: an Indian analysis

Parameshwar P Iyer

Indian Institute of Science, India

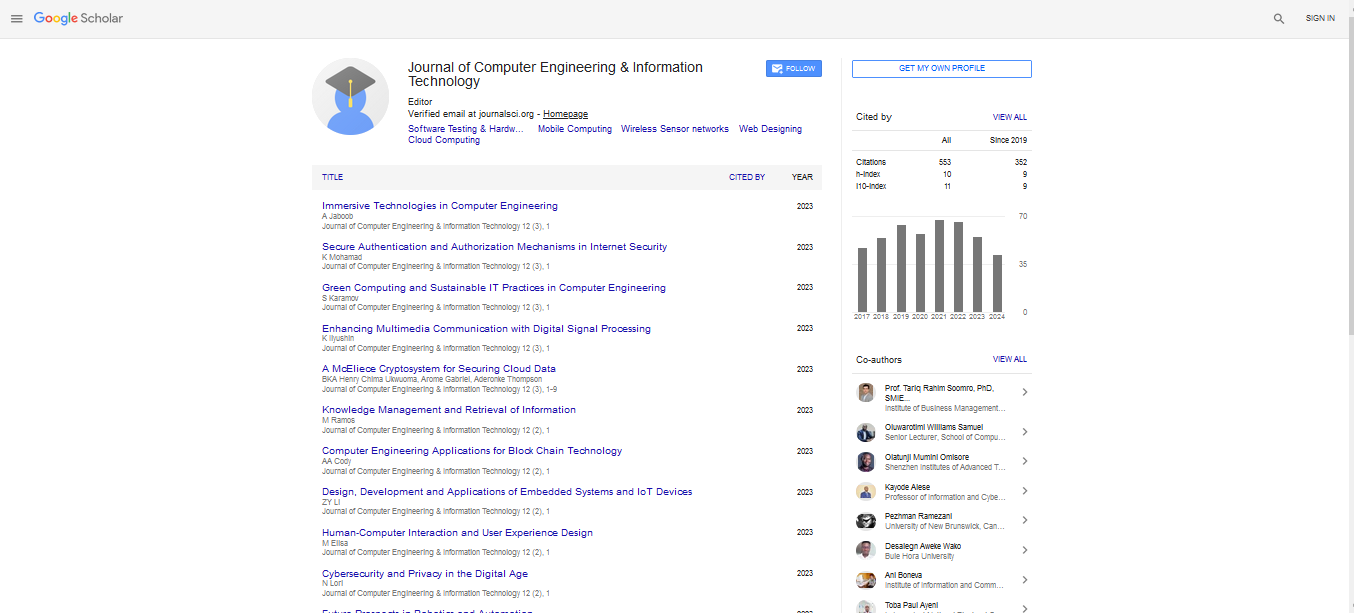

: J Comput Eng Inf Technol

Abstract

An important application of big data analytics in finance is to find a method of valuing the company stock(s), based on several variables, derived from some or all of the following factors: 1) environmental factors; 2) business factors; 3) management factors; 4) factors related to financials; 5) valuation related factors; and 6) regulatory and other factors. In other words, given a company stock, we should be able to value it and decide whether to invest in it or not. The traditional method followed in investing is to try and calculate the intrinsic value of the stock based on a number of methods such as discounted cash flow, projecting the earnings and using the forward price to earnings multiple or the forward enterprise value to EBITDA multiple. However, this process is highly subjective and highly based on the assumptions used in the model. Different analysts could come up with very different estimates of the intrinsic value of the company.

Biography

Parameshwar P Iyer has earned his Bachelor’s, Master’s, and Doctoral Degrees from IIT Kharagpur, Universities of Illinois at Urbana-Champaign, and University of California at Davis, respectively. He has been on the Faculties at Rutgers University—the State University of New Jersey (in the USA), and at the IIT Kharagpur, IIM Kozhikode, and IISc Bangalore (all in India), where he is currently pursuing Research, Teaching, and Consulting in Management of Innovation, Projects, and Entrepreneurship. He has published more than 50 papers in reputed journals and has been serving as an Editorial Board Member of repute in a number of international and national peer-reviewed journals.

E-mail: piyeriisc@gmail.com

Spanish

Spanish  Chinese

Chinese  Russian

Russian  German

German  French

French  Japanese

Japanese  Portuguese

Portuguese  Hindi

Hindi