Mini Review, Res J Econ Vol: 7 Issue: 5

Why Should Developing Countries Adopt Flexible Exchange Rates Regime: A Review

Francesco Spizzuoco*

Department of Structural Engineering and Architecture, University of Naples Federico II, Naples, Italy

- *Corresponding Author:

- Francesco Spizzuoco

Department of Structural Engineering and Architecture,

University of Naples Federico II,

Naples,

Italy;

Email: francesco.spizzuoco. 16@alumni.ucl.ac.uk

Received date: 04 September, 2019, Manuscript No. RJE-23-2097;

Editor assigned date: 09 September, 2019, PreQC No. RJE-23-2097 (PQ);

Reviewed date: 23 September, 2019, QC No. RJE-23-2097;

Revised date: 14 June, 2023, Manuscript No. RJE-23-2097 (R);

Published date: 12 July, 2023, DOI: 10.4172/RJE.1000155

Citation: Spizzuoco F (2023) Why Should Developing Countries Adopt Flexible Exchange Rates Regime: A Review. Res J Econ 7:4.

Abstract

In this review, I summarize why developing countries should adopt a flexible exchange rate regime by casting doubt on the effectiveness of a fixed exchange rate regime for such countries. In section 1, I analyse the reasons underlying the choice for exchange rate regimes from both economic and political perspectives. In section 2, I highlight the pitfalls of fixed exchange rate regimes in developing countries by considering the case of Southeast Asian countries and Argentina in the late ninties. In the last section, I focus on the advantages of a flexible exchange rate regime as both an external shock absorber and a catalyst for economic growth: By comparing the west and central african countries that make up the CFA zone to their sub-Saharan peers, I argue that GDP growth has been hindered by a fixed regime. My conclusion is that developing countries can largely benefit from adopting a flexible exchange rate regime: This would absorb external shocks, lead to a rapid economic growth and avoid the cross-rate fluctuations, which are catastrophic for trade.

Keywords: Economic growth, Gross domestic product, Asian financial crisis, Exchange rate

Introduction

Over the past four decades, many developing countries have shifted from fixed to flexible exchange rate regimes in order to achieve rapid and stable economic growth in an increasingly globalized world and liberalized markets. While this shift has been blatant worldwide, there are some exceptions, such as the African Financial Community (CFA) zone. In developing countries, the rather meagre success of fixed exchange rate regimes has been counter balanced by catastrophic episodes of unsuccessful exchange rate systems, such as the 1997 Asian financial crisis and the austral convertibility law in Argentina. These episodes stress the benefits of a flexible exchange rate for a developing country [1]. In my essay, I will cast doubt on the effectiveness of fixed exchange rate for emerging economies and will explain why a flexible exchange rate is worthwhile. For simplicity, I assume that developing countries can only adopt corner solutions, namely hard pegs (or fixed) or freely floating (or flexible) exchange rates. In section 1, I analyse the reasons underlying the choice for exchange rate regimes from both economic and political perspectives. In section 2, I highlight the pitfalls of fixed exchange rate regimes in developing countries and in the last section, I focus on the advantages of a flexible exchange rate regime as both an external shock absorber and a catalyst for economic growth. The empirical evidence to which I refer demonstrates that developing countries can largely benefit from adopting a flexible exchange rate regime [2].

Literature Review

How do countries choose their exchange rate regimes?

The aim of this section is to describe the way developing countries choose exchange rate regimes. Since their economy relies heavily on international trade and capital flows “large swings in exchange rate can cause very substantial swings in the real economy”. Especially when the majority of the debt is held in a foreign currency, a depreciation of the domestic currency against the foreign one can have deleterious consequences on the financial and banking system of a country [3]. Hence, monetary authorities in developing countries may exhibit the so-called “fear of floating” namely a hesitation in allowing free fluctuations of the exchange rate. Based on this concept, developing countries, especially those with economies greatly dependent on trade, will adopt a fixed exchange rate system to minimize such fluctuations [4].

This idea seems to be consistent with theory about the optimal choice of an exchange rate regime, which takes place by considering their effectiveness in reducing “volatility of domestic output in an economy with sticky prices”. Thus, the nature of economic shocks, which can be either nominal or real, largely determines the choice for a particular exchange rate regime [5]. If the shock is nominal, a fixed exchange rate system is more attractive because the change in the money demand or supply can be accommodated with less variation in output. On the other hand, when shocks are real, such as a shock to productivity or to the terms of trade, the economy can respond to the change in relative equilibrium prices, by shifting the nominal exchange rate without having deleterious effects on output and employment. If an economy adopts a flexible exchange rate regime and faces a nominal shock, there will be a depreciation of the floating currency and the nominal shock will be automatically translated into a real one, which can be adjusted using the standard monetary policy mechanisms. For real shocks, a fixed exchange rate exacerbates the economic downturn: The demand for domestic currency falls and the excess supply can be absorbed only by exchanging foreign currency, which inevitably causes an outflow of hard currency and a rise in interest rates. Consequently, developing countries which are often buffeted by large real shocks from abroad should adopt a flexible exchange rate [6].

Nonetheless, as Velasco put it, “for exchange-rate flexibility to be stabilizing, it has to be implemented by independent central banks whose commitment to low inflation is credible”. If this is not case, central banks are not able to control inflation and avoid large depreciations of the domestic currency. Therefore, the institutional design, the financial architecture and the banking system matter for the choice of an exchange rate regime. Complementary fiscal and banking policies need to be implemented in order for a flexible exchange rate to be successful. In first place, this can be guaranteed by the independence and credibility of central banks, which have increased significantly over the past decades in developing countries. To this extent, the choice of exchange rate regimes depends not only on economic factors, but also on the political and institutional features of a developing country [7].

The arguments against fixed exchange rate in developing countries

While a fixed exchange rate may give a country “simplicity, transparency and observability” from both a political and an economic viewpoint, there are some major drawbacks that make its acquisition a less viable option for developing countries. These include detrimental cross-rate fluctuations and the absence of the central bank function of ‘lender of last resort’, which I will discuss in this section by referring to two recent historical events [8].

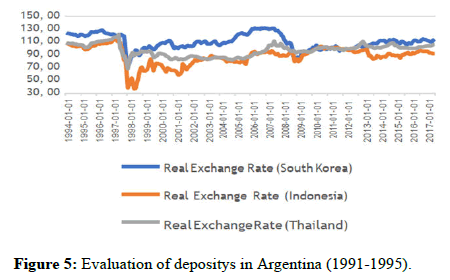

Pegging to one currency means floating against all the others. For example, Southeast Asian economies, which pegged their currencies to the dollar in the late ‘70s, suffered from the sharp appreciation of the dollar against the yen because this had been transmitted to a sudden exchange rate appreciation for several Southeast Asian countries. An exchange rate appreciation deteriorated the current account because it had caused a slowdown of Southeast Asian exports compared to the peer countries, such as China and Japan.

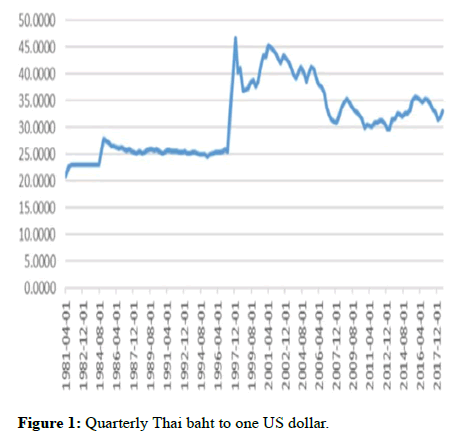

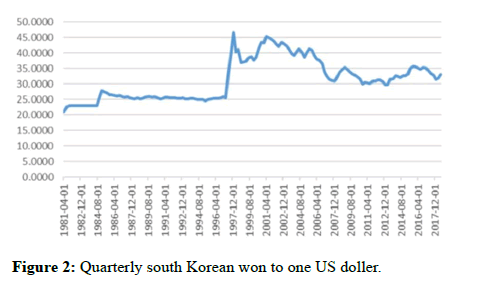

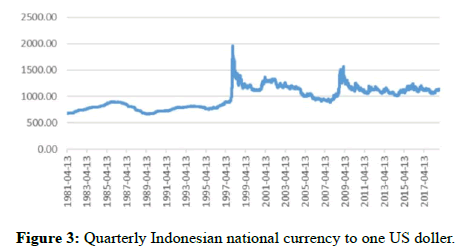

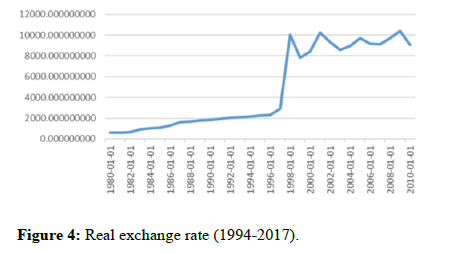

Thailand, Indonesia and South Korea were the countries that were mostly hit by the 1997 Asian financial crisis because of their common rising public debt and weakly supervised foreign borrowing, which destroyed investors confidence in the current exchange rate. This promoted a speculative attack towards the Thai baht, the Korean and the Indonesian rupiah, which appreciated by around 80%, 130%, 300% respectively. As a result of this sudden appreciation, the South Korean current account fell by more than 25%, while the Thai and the Indonesian by 5% and 11% respectively (Figures 1-4) [9].

Many have posited that the 1997 Asian financial crisis had been a result of Asian countries pegging to the US dollar despite having a quite diversified trade. Therefore, advocates to the fixed exchange rates claim that they should have pegged to a basket as to insulate countries from cross-rate fluctuations. However, moving towards a complex basket system seems to undermine the main virtues of a currency board and would imply that “pairwise exchange rates fluctuate as much as international cross-rates do”. Thus, the Asian episode exhibits the value of adopting a flexible exchange rate regime in order to maintain international competitiveness [10].

Discussion

Furthermore, fixed exchange rate regimes sacrifice the function of “lender of last resort” to the domestic banking system, which catalyzes “self-fulling bank runs”. This is exemplified by the Argentine crisis in the late ‘90s, which was a consequence of two constraints posed by the adoption of the fixed exchange rate. In the first instance, there was a “fiscal constraint” because the fixed exchange rate regime made money supply endogenous: A loss of dollar reserves would have followed after any attempt to issue currency above this amount, posing a threat to the convertibility of the domestic currency. The second constraint was merely “monetary”: There had been a de facto “dollarization” of the financial intermediaries, whereby private-sector banks could issue deposits and grant loans in both pesos and U.S. dollars at a one-to-one conversion rate. These two constraints implied that the central bank could not bail out private-sector banks by printing more money and acting as a lender of last resort [11].

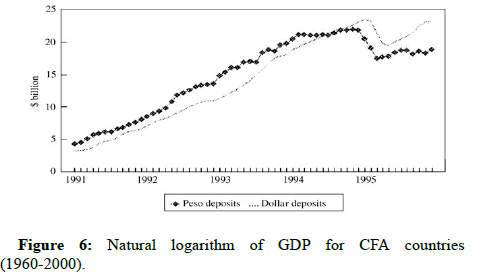

Following the Mexican devaluation of 20 December 1994, the “Tequila effect” spread to Argentina where investors were fearing that the country could not maintain the peg. Ultimately, this generated a substantial outflow of capital, with 18.4% deposits denominated in both peso leaving the Argentine commercial banks between 1994 and 1995, causing the bankruptcy of nine commercial banks. To this extent, the Argentine crisis is considered “both a currency run and a bank run” (Figure 5) [12].

The examples of Argentina and South Eastern Asian countries highlight the dangers of a fixed 3 Schumacher. “Bank runs and currency run in a system without a safety net: Argentina and the ‘tequila’ shock”, journal of monetary economics exchange rate regime: Cross-rate instability and the absence of a lender of last resort function of the central bank are perilous for developing countries [13].

Advocating for a flexible exchange regime in developing countries

The basic case for flexibility for developing comes in light of the views of classical liberalism: A country should adopt a flexible exchange rate so as to insulate its economy from external shocks and to satisfy domestic goals. Therefore, exchange rate flexibility becomes a very appealing solution for countries that are often hit by shocks to the goods markets. In this section, I will empirically illustrate the impact of a real shock on developing countries adopting a fixed exchange rate [14].

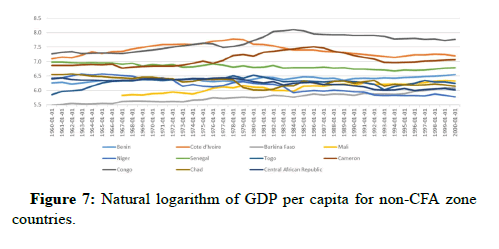

Since their independence, fourteen West and Central African countries, which make up the so-called cfa zone, have maintained a fixed parity to the french franc and since 1999, to the euro. At the time of its creation, the CFA zone brought notable benefits, such as low inflation levels and much optimism because it would have brought a steady investment climate. Nevertheless, compared to their sub- Saharan peers, which were adopting flexible exchange rates, CFA member countries were unable to adjust to the frequent shocks in their terms of trade that occurred in the 80’s. When the prices of their main exports (oil, coffee and cocoa) increased in the 70’s, CFA countries “could not use nominal devaluations as an instrument of adjustment” while their competing sub-Saharan countries managed to regain competitiveness through large changes in their nominal exchange rates. As a consequence, after 1981, the GDP growth rate of these countries was much smaller than their sub-Saharan counterparts (Figure 6).

The CFA zone episode shows that a fixed exchange rate regime can be a bad bargain for developing countries: While it assures inflation at low levels and hence price stability, it may hinder GDP growth rate as a result of the inability to fast adjustment after an external shock (Figure 7).

Conclusion

In a rather cynic manner, Rose upholds that choosing exchange rate regimes is equivalent to choosing between tea and coffee, as this is a matter of preferences. While this statement appears to seem consistent with the fact that in the last decades developing countries have moved towards corner solutions, the examples of the CFA zone, the 1997 Asian financial crisis and the Argentine failure of the ‘convertibility plan’ exhibit that the ‘real’ effects of not “getting the exchange rate right” St. Louis fed research GDP per capita, annual frequency, natural logarithm method. Retrieved from are far-reaching and deserve to be investigated. By precisely doing that, I argue that moving towards flexible exchange rates is reasonable for developing countries with an open economy because it might absorb external shocks, leading to a rapid economic growth and avoid the cross-rate fluctuations, which are catastrophic for trade.

References

- Browne C, Caramazza F, Aziz J (1998) Fixed or flexible? getting the exchange rate right in the 1990s. Int Monet Fund 18: 1-18.

- Veyrune R (2007) Fixed exchange rates and the autonomy of monetary policy: the franc zone case. Int Monet Fund 2: 54-59.

- Milner HV, Kuobta K (2005) Why the move to free trade? democracy and trade policy in the developing Countries. J Deve Econ 59: 107-143.

- Calvo GA, Reinhart CM (2002) Fear of floating. Quart J Econom 117: 379-408.

- Calvo GA, Mishkin FS (2003) the mirage of exchange rate regimes for emerging market countries. J Econ Perspect 17: 99-118.

- Mundell RA (1961) A theory of optimum currency areas”. Am Econ Rev 51: 657-665.

- Herrendorf B (1997) Importing credibility through exchange rate pegging. Econ J 107: 687-694.

- Herrendorf B (1999) Transparency, reputation and credibility under floating and pegged exchange rates. J Int Econ 49: 31-50.

- Obstfeld M, Rogoff K (1995) Exchange rate dynamics redux. J Polit Econ 103: 624-660.

- Schumacher L (2000) Bank runs and currency run in a system without a safety net: Argentina and the ‘tequila’ shock. J Monet Econ 46: 257-277.

- Harvey ZH, Chen Y, Jarosz DF (2018) Protein-based inheritance: Epigenetics beyond the chromosome. Mol Cell 69: 195-202.

[Crossref] [Google Scholar] [PubMed]

- Chiesa G, Kiriakov S, Khalil AS (2020) Protein assembly systems in natural and synthetic biology. BMC Biol 18: 1-18.

[Crossref] [Google Scholar] [PubMed]

- Ameta S, Matsubara YJ, Chakraborty N, Krishna S, Thutupalli S (2021) Self-reproduction and Darwinian evolution in autocatalytic chemical reaction systems. Life 11: 308.

[Crossref] [Google Scholar] [PubMed]

- Sigurdson CJ, Bartz JC, Glatzel M (2019) Cellular and molecular mechanisms of prion disease. Ann Rev Pathol Mech Dis 14: 497-516.

[Crossref] [Google Scholar] [PubMed]

Spanish

Spanish  Chinese

Chinese  Russian

Russian  German

German  French

French  Japanese

Japanese  Portuguese

Portuguese  Hindi

Hindi