Review Article, J Fashion Technol Textile Eng S Vol: 0 Issue: 5

Improving the Innovation and Training Capacity of the Textile Companies

Blaga M1*, R�?�?dulescu IR2, Ghezzo P3, Almeida L4 and Stjepanovic Z5

1Gheorghe Asachi Technical University of Iasi, Iasi, Romania

2Institutul National De Cercetare-dezvoltare Pentru Textile Si Pielarie (INCDTP), Bucharest, Romania

3Centro Tessile Cotoniero e Abbigliamento, CENTROCOT, Italy

4TECMINHO, Guimaraes, Portugal

5University of Maribor, Maribor, Slovenia

*Corresponding Author : Mirela Blaga

“Gheorghe Asachi” Technical University of Iasi, Iasi, Romania

E-mail: mblaga@tex.tuiasi.ro

Received: October 10, 2018 Accepted: November 09, 2018 Published: November 14, 2018

Citation: Blaga M, Radulescu IR, Ghezzo P, Almeida L, Stjepanovic Z (2018) Improving the Innovation and Training Capacity of the Textile Companies. J Fashion Technol Textile Eng S5:008. doi: 10.4172/2329-9568.S5-008

Abstract

The Erasmus Plus project "Matrix of knowledge for innovation and competitiveness in textile enterprises", TEX Matrix, aims at spreading creative and innovative organizational culture inside textile enterprises, by transferring and implementing methodologies, tools and concepts for improved training. Within this paper, an overview of the contents, goals and objectives of this project is given. The project has achieved at this stage two important intellectual outputs: the design of Knowledge Matrix of Innovation (KMI) and the benchmarking study. The KMI developed in the framework of the project, aims to create a comprehensive image of the intangible assets of an enterprise, such as: innovation strategy and culture, informational resources, training methodology, relationships portfolio, IP rights. The benchmarking study comprehended the following goals: elaboration of a database with textile enterprises, adaptation of the benchmarking matrix, and organization of the process for benchmarking. The benchmarking report is analyzed through SWOT and gap analysis and solutions will be provided by the project's partners for improving the innovation and training capacity of the enterprises. The project partners support the enterprises by means of their latest research results and training methods. They are able to identify gaps in the innovation capacity of enterprises based on the benchmarking study and to enrich it with new solutions. The impact of the work results is expected to increase the quality of training, by combining innovative contents with attractive methods.

Keywords: Benchmarking; E-learning; Knowledge matrix of innovation

Introduction

The TEX Matrix project - “Knowledge matrix for innovation and competitiveness in textile enterprises” is a continuation of the Advan2Tex project, with the benefit of experience and very good cooperation between project partners and also with the stakeholders from textiles. TEX Matrix is focused on improving innovation capacities inside the textile enterprises. It is industry-oriented and has as target group two main categories: the decision-making staff of the enterprises and young employees in the textile field. While Advan2Tex set the starting point with the e-learning courses in innovative textile fields, this project is entering into the sphere of textile enterprises and to improve their innovation capacity. The consortium of the project reflects a very well-balanced distribution of activities and responsibilities. There are two research institutes and two universities and one training center, from four countries with great importance for the textile industry in Europe: Italy, Portugal, Romania and Slovenia. All five organizations involved in the project are representative for training purposes in their countries with a complex relational framework, including connections to SMEs, professional associations, chambers of commerce, clusters, competitiveness poles and other actors from this industrial chain. The impact of the project is going to be accordingly high, having in mind the weight of these organizations in the economic perspective of their countries.

Innovative Project Outputs

The TEX Matrix project envisages the improvement of the knowledge matrix for innovation for a large target group of textile enterprises with the contribution of the research providers of the consortium.

The project has the following new outputs towards other projects carried out:

O1-The innovative concept of the Knowledge Matrix for Innovation (KMI),for the quantification of the intangible assets in a textile enterprise.

O2-The benchmarking study based on the KMI in textile enterprises on European level will highlight the strengths, weaknesses, opportunities and threats for the individual matrix of each enterprise.

O3-The guide comprising ofnew solutions, possibilities of technological transfer of research results, towards the enterprises, to improve their innovation capacity.

O4-The e-learning tool developed on the Advan2tex Moodle platform and will host the guide with new solutions.

The project has achieved in its second year, two important intellectual outputs: the design of KMI and the benchmarking study. These two intellectual outputs servefor accomplishing the guide with new solutions for textile enterprises and the e-learning tool and workbased learning. The elaboration of the KMI involved the following tasks: identification of all relevant factors for the knowledge matrix for innovation and adaption to the textile field and elaboration and validation of the final structure for the knowledge matrix for innovation. The KMI has been extensively presented and details have been given concerning the content [1-5]. The final form of the KMI developed within the project framework is presented in Table 1.

| No. | Element | Criteria | Factors |

|---|---|---|---|

| 1 | Conditions | Innovation culture | 5 |

| Innovation strategy | 5 | ||

| Leadership | 4 | ||

| 2 | Resources | Human resources | 5 |

| Organizational structure | 4 | ||

| Material resources | 3 | ||

| External relationships | 4 | ||

| Financial resources | 1 | ||

| 3 | Activities | Management of ideas | 2 |

| Management of innovation projects portfolio | 2 | ||

| Surveillance and knowledge management | 3 | ||

| Innovation promotion | 2 | ||

| IPR | 3 | ||

| 4 | Results | Evaluation and monitoring | 5 |

| Image (Brand) | 3 | ||

| Learning from failures | 1 |

Table 1: Structure of the KMI.

This paper focuses on the benchmarking study presentation and the conclusions regarding the company’s positions and perspectives.

Benchmarking Study

Benchmarking represents an instrument of investigation that measures the performance through various financial and non-financial indicators. The benefits of benchmarking have been well recognized in certain industries and operating areas. It has also advanced business concepts with general management applications for strategic planning, restructuring, financial management, succession planning.

The final form of the KMI has been agreed among the partners and a new tool for in-depth investigation has been created, under the form of one questionnaire developed to measure the aptitude for the innovation of the participating companies. The questionnaire consists of a first part regarding company’s generality, followed by four areas, primary objects of the survey: Conditions, Resources, Activities and Results, the main parts derived from the KMI. The benchmarking questionnaire is available on-line in the partner countries languages, to be applied to the domestic textile companies. Each area of inquiry is then divided into specific sub-areas, where the issues are analyzed in the related questions. Questions are divided into two types:

Likert scales, with selectable values from 0 to 5, referring to the overall PDCA model of total quality management (Table 2).

| 0 | 1 | 2 | 3 | 4 | 5 | |

|---|---|---|---|---|---|---|

| The company evaluates the implication of innovation results in the product brand | ||||||

| There is an evaluation of the innovation policies impact on the success of the company brand | ||||||

| There is a regular assessment of the growth level of the company visibility |

Table 2: LIKERT Scale Question.

Multiple Answering Questions where the interviewee can choose between a rose of alternatives is given below.

What activities regarding IPR does the enterprise apply?

a) internal patents

b) acquisition of patents

c) documentation on patents

d) acquisition of licensees

The reference sample is comprised of 63 companies of which: Italian for 14.3%, Slovenian for 15.9%, Portuguese 19% and Romania 50.8%. All the companies are from the textile sector, most (57.1%) operate in clothing/fashion, followed by technical fabrics (41.3%). Most companies, 63.5% operate in one sector, the trend decreases progressively (19% from 2 sectors, 14.3% for 3 sectors, 1.5% for 4 sectors and 0 for 5 sectors), and although it should be noted that 1 company has compiled all 6 sectors. There is also a fairly proportional trend along the traditional production chain: a few spinning (4) followed by several fabric producers (12) which them are composed by 10 weaving manufacturer and 2 knit manufacturer; there is a contraction in the number of dying and printing companies (10) followed by an expansion of companies operating in Clothing/Fashion. Although some companies have filled multiple choice (yarn/fiber producer and clothing), companies that only operate in clothing/ fashion and are therefore not producing textiles, yarns or dyes are 23.

Diversification by number of employees is the field that records one of the most homogeneous of the sample being analyzed, and varies between 22.2% and 30.2%. Therefore, as significantly homogeneous will be taken as a distinctive factor for subsequent analyzes. The results show that 54% of sample companies consist of more than 50 employees.

As far as exports are concerned, the share above 75% is the highest one (41.3% of the total). It can be noted that more than half of the companies export more than half of the products (adding the number of companies exporting from 50 to 75% and over 75%). By interpreting the data, it is possible to state that the export area of 50-75% is the demarcation line, attributable to internal or market choices, between the export-oriented or the internal market. It should also be emphasized that a considerable share of the reference sample, the (19.0%), is exclusively for the domestic market.

Despite the homogeneous distribution found in the company size, the turnover of the companies is less homogeneous, it can note the largest area is between 1 and 10 million euro and 63% of businesses have a turnover of less than 10 million euro (Figure 1).

Regarding investment in innovation activity, the question is open, for easier analysis it has been decided to split into defined clusters. These clusters are: between 0 and 1%; between 1 and 5%; between 6 and 10%; between 11 and 20%; over 20%. It emerges that most companies do little investment in innovation activities: 63.5% have a share between 0 and 5%, of which 18 companies altogether are in the range of 0 to 1%. Two companies represented over 21% of the share of innovation activity, which raised considerably the average (6.9%), as presented in Figure 2.

Innovation is mainly aimed to the introduction of new products on the market, so it can be assumed that the main driving force is the profits increase, and it is obtainable by product development, another important factor is addressed to increase market share. The increase of production capacity register a lower interest, although the "2" and "3" options have the highest values. It can therefore be inferred that the priorities in terms of innovation and development is lead to obtain a reference position or to consolidate a dominant position on the own market.

As far as innovation strategies are concerned, it can be observed that 23 companies, or 36.6%, attribute an average value to the medium and long-term innovation policies shared with employees. The same condition is recorded regarding innovative strategies translated into medium to long-term objectives (33.3%), as well as the resourcevaluation sector (30.2). The value decrease on the value "2" with a 33.3% for the presence of a regularly evaluated plan with employees and external actors. However, as far as the evaluation of regularly monitored projects is concerned, companies give an average high rating, in fact, only 19% rated "0" and "1" (Figure 3).

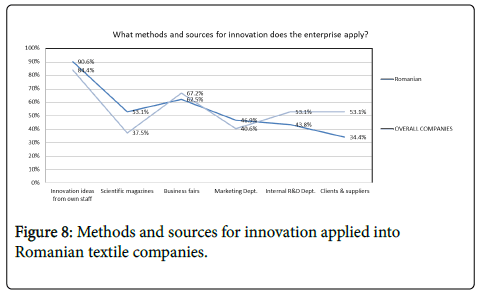

The positioning of companies in planning for the development and implementation of innovative ideas is on medium-high value: 69.3% is distributed in the range of "3" and "5" values (Figure 4). The methods and the resources for innovation that the companies interviewed use are different, the most significant issue being the development of ideas from internal staff (84.1%), while 68.3% is targeted at industry fairs. The relationship with customers and suppliers plays an important role, in fact 52.4% of companies have such policies.

The benchmarking report has been analyzed through SWOT and gap analysis and solutions will be provided by the project's partners for improving the innovation and training capacity of the enterprises.

SWOT analysis, meaning the analysis of key or critical success factors, belongs to the highest ranked set of techniques of strategic analysis used by firms in empirical surveys [6]. External and internal analysis are used for carrying out the SWOT analysis. The main purpose of the external analysis is to identify opportunities and threats in the organization’s operating environment, while the internal analysis seeks to count the organization’s strengths and weaknesses [7]. When analysing the Report on Benchmarking Questionnaire, several important Opportunities related to the four Elements of the Matrix of knowledge for innovation and competitiveness in textile enterprises: Conditions, Resources, Activities and Results were indicated. Taking into account a number of Criteria within the Elements, it can be seen that the companies, involved into the Benchmarking, are aware of the importance of innovation for assuring their competitiveness. New technologies, IT solutions and potential new markets represent the main opportunities for textile-related industries.

The analysis of the Threats reveals some important negative external influences, which represent a potential danger for textile and clothing companies. In general, they mostly relate to lack of available financial and other resources for assuring an effective innovation strategy.

The benchmarking study established the position of an enterprise on local/regional/national/European level and statistical reports and charts upon the current situation of the textile industry on local/ regional/national/European (consortium) level, will be carried out. The example of the Slovenian companies within this study is given for a better understanding of this evaluation.

The analysis of the Benchmarking survey showed that in general, Slovenian companies have similar trends for most of the all investigated Elements, Criteria and Factors, when compared to average of all overall companies, included into the survey. However, there can be noted some deviations.

For example, the innovation activities of the Slovenian companies regarding the technologies, design, services, IT and sales are higher than overall sample in a range of +0.33 for technologies and +0.78 for sales, whilst the products and research innovation activities are slightly lower than the overall sample, Figure 5. It should be noted that, unlike the overall average, IT (3.40) is higher than research (2.90).

Also, within the Slovenian companies, there are some significant differences regarding some elements, Criteria and Factors. Figure 6 shows the types of training activities for one more successful Slovenian company (S1) in relation to overall companies and Slovenian companies.

Romanian Companies reported slightly greater values for HR and training policies that encourages/promote innovation, compared with consortium companies indicators and smaller values for employees related indicators (team players in innovation and adequate technical skills), and compared with the rest of the companies, as displayed in Figure 7.

Regarding the methods and sources for innovation applied into Romanian textile companies, the situation presents higher average values for innovation ideas from own staff (-0.06) and documentation from scientific magazines (-0.16), as well as the work performed by the Marketing Department (-0.05), as shown in Figure 8. Nevertheless, lower average values are registered for participation to business fairs (+0.05), ideas from the internal R&D Department (+0.9) and clients and suppliers (+0.18).

This situation shows a focus of the Romanian companies on the internal sources for innovation, such as ideas from own staff and scientific magazines, in comparison with the consortium average companies (IT, PT, SI), with a focus on external sources, such as the internal R&D department and the information received from clients and suppliers.

Guide with New Solutions

The benchmarking report has been carried out, as well as SWOT and gap analysis, and solutions will be provided by the project's partners for improving the innovation and training capacity of the enterprises. Several research results and new training methods will be provided by the project's partners. The Guide will establish the framework for the identification of the needs for innovation and training of textile enterprises with the involvement of research providers. The aim of the Guide is to develop a support system for raising awareness regarding the role of innovation and training in enterprises. This will lead to their increase of competitiveness and to the implementation of an innovation-oriented management [5].

E-leaning Tool

The main sustainable output of the project is the e-learning on-line tool, having the following results on an enlarged target group. The next output, the e-learning tool, aims at rendering solutions to the textile enterprises participating in the benchmarking study, based on the guide with new solutions. The solutions from the guide, including research results and new ideas for improving innovation capacity for textile enterprises, will be transformed in e-learning content; the e-learning content will have text, graphics and videos. The content will be scheduled interactively, in order to attract the young trainees in textiles and will be hosted at www.advan2tex.eu.

Conclusion

The added European value relates first and foremost to the quality project's products and their implementations. The impact of the project is to add value to the European strategy for supporting textile sector in the global competition.

References

- Gregor S, Hevner AR (2014) The Knowledge Innovation Matrix: A clarifying lens for innovation. Int J of an Emerging Transdiscipline 17: 217.

- Blaga M (2017) Innovative solutions for textile companies competitiveness. Proceedings of the XXI International Scientific Conference.

- Blaga M, Harpa R, Radulescu IR, Stepjanovic Z (2017) E-learning for textile enterprises innovation improvement’’, 17th World Textile Conference AUTEX 2017- Textiles - Shaping the Future, IOP Publishing IOP Conf. Series: Materials Science and Engineering 254.

- Martins EC, Terblanche F (2003) Building organizational culture that stimulates creativity and innovation. European Journal of Innovation Management 6: 64-74.

- www.advan2tex.eu

- Glaister KW, Falshaw RJ (1999) Strategic planning: Still going strong? Long Range Plann 32: 107–116

- Jeyaraj KL (2012) Application of SWOT and Principal Component Analysis in a Textile Company - A Case Study. International Journal of Engineering Research and Development 1: 46-54.

Spanish

Spanish  Chinese

Chinese  Russian

Russian  German

German  French

French  Japanese

Japanese  Portuguese

Portuguese  Hindi

Hindi